Cannabis 2.0: The Rise of Automated Cannabis Processing

Advances in cannabis processing are being driven by a rapidly expanding market and skyrocketing demand for cannabis products. The introduction of AI and other new machine-learning processes and technologies are quickly shaping cannabis productions.

Mobius is leading the way with the world’s best cannabis trimming machine and processing equipment. Post-harvest cannabis processing equipment and technologies streamline every step of your workflow, cut labor, and reduce repetitive strain injuries.

Cannabis processing is a multi-step process that begins after harvest and goes through production, packaging, and sale. Cannabis is harvested when it has reached full maturity, then processed for further applications like extracts and prepared for retail sale.

The steps in processing marijuana for sale include bucking, trimming, curing, and sorting.

- Bucking in cannabis processing is the method of separating harvested plant material from the stems and stalks. Cannabis flowers are removed from the plant before being trimmed.

- Trimming involves removing the fan and sugar leaves from the flower to isolate the bud from the excess leaves and plant material. This gives the flower its desired look and shape for retail sale. This can be done by hand or machine. Cannabis processors have found that machine trimming is more efficient and cost-effective than manual trimming. It eliminates human error and significantly reduces labor and operating costs. Cannabis trimmed by machine also has fewer losses throughout the process than hand trimming.

- Curing involves slowly drying the flower over time to bring out the plant’s natural flavors and aromas and to create a more potent product. After the initial drying, the plant material is stored in air-tight containers and dried further—sometimes for several months—until it reaches the desired moisture content for sale.

- Sorting is the final step in the process. Cannabis farmers use sorting machines to separate buds by size for retail sale. These machines enable processors to maximize the value of each plant by ensuring the larger, highest-quality buds fetch top prices, while the smaller buds can be sorted out for products like pre-rolls. Additionally, they allow producers to automate this process so they can focus attention on other aspects of production and overall quality control.

Cannabis growers are increasingly turning to automation to streamline the process and increase productivity. Automation offers a more consistent product with less waste and lower overall costs, making it an attractive option for a cannabis cultivation center or processing facility. Consistency leads to speed, allowing processors to get products to market faster without sacrificing quality.

No matter what method is used, cannabis processing requires careful attention to detail to produce high-quality products.

Hand vs. Machine Bucking Cannabis

Processing cannabis is a laborious task, but one of the most important steps is bucking: manually or mechanically removing the flowers from the stems of the cannabis plant.

Hand bucking requires an individual to pick off each flower and remove it from the stem, which can be incredibly time-consuming for a larger harvest and commercial-scale operations.

Alternatively, machine bucking utilizes specialized machinery that achieves the same result in a much shorter time. The plant matter is simply inserted into an automated device that quickly strips away flower material with greater accuracy, precision, and efficiency than human hands are capable of.

When processing large quantities of cannabis, machine bucking is the superior method due to its speed and productivity. Not only does this eliminate significant labor hours, but it also reduces spending on wages or managing staff, making it much more cost-effective than hand bucking. Commercial bucking machines like the Mobius MBX also feature an integrated stem chipper. The stem chipper works while the machine is pulling the buds from the stalks and chips the stems into small pieces, making waste disposal and disposal costs obsolete.

Hand vs. Machine Trimming Cannabis

Trimming cannabis is the process of removing leaves and excess plant material from the cannabis flower. Wet trimming is usually done when the plant matter still has some moisture content (typically 18%+), and dry trimming is done after the flowers have dried (around 9-11% moisture).

In hand trimming, someone typically uses scissors to cut off any excess leaves, stems, crow’s feet, and unwanted bits from the buds to get a smooth, appealing surface.

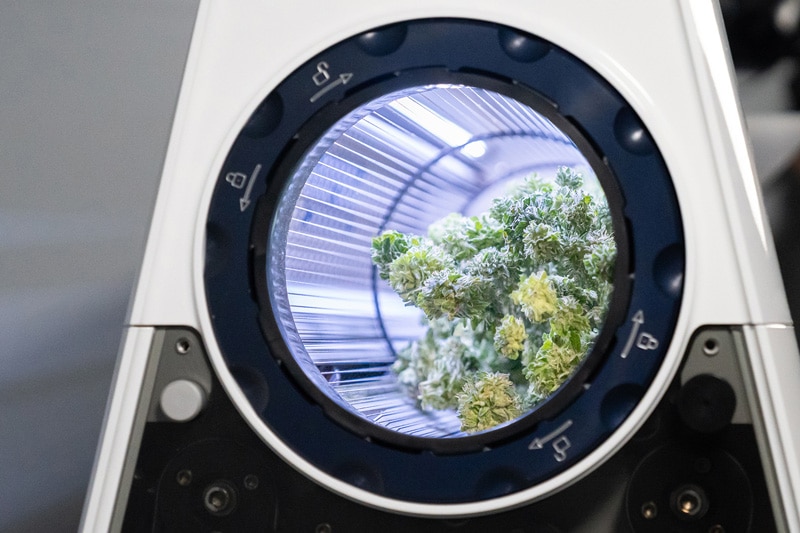

Machine trimming cannabis, on the other hand, usually involves a commercial cannabis trimmer with rotating blades that capture and separate leaf matter from flowers quicker than hand trimming.

Compared to manual labor, machine trimming is faster, more efficient, and much more cost-effective as you don’t have to manage a team of hand trimmers and pay for seasonal workers. Hand trimming is simply not efficient enough for larger processing facilities and cultivators handling multiple harvests a year. Cannabis producers with large multi-acre harvests require higher speeds, cost consciousness, and consistency.

Machine trimming offers faster output, reduced labor costs, improved waste management, and precision—with the most updated machines delivering hand-trim quality results. The Mobius M108S Trimmer accomplishes all of these factors with ease as a revolutionary commercial cannabis trimmer.

Hand vs. Machine Sorting Cannabis

You can optimize your harvest with a bud sorter. Sorting cannabis flower is the process of separating buds based on size. Separately sorting by size, shape, and appearance helps maintain consistency when packaging cannabis products.

The traditional way of hand sorting requires experienced workers to grade and sort each bud. This method can be labor intensive, and results may vary based on their skill and experience level. As a result, there is little to no consistency in the size and quality of grading across the cannabis industry.

Machine sorting cannabis works by using multiple belts. Buds then filter through each section of belts based on their size, where they can then be moved on to the next phase of processing.

Using a commercial bud sorter allows buds to be separated more quickly and accurately than humans can manage on a much larger scale. The M9 Sorter is four times faster than its closest competitor and can sort up to 440 lbs of flower per hour.

With machine sorting, you have standard criteria that are used consistently from harvest to harvest, eliminating variability between each batch or different packaging runs. Ultimately, machine-sorting cannabis provides larger yields in less time with much higher efficiency than traditional hand-sorting methods.

Hand vs. Machine Processing Cannabis

Manual cannabis processing is quickly becoming an outdated way of processing cannabis. As the markets for cannabis products continue to grow, the demand for a higher-quality product at a lower price will only increase.

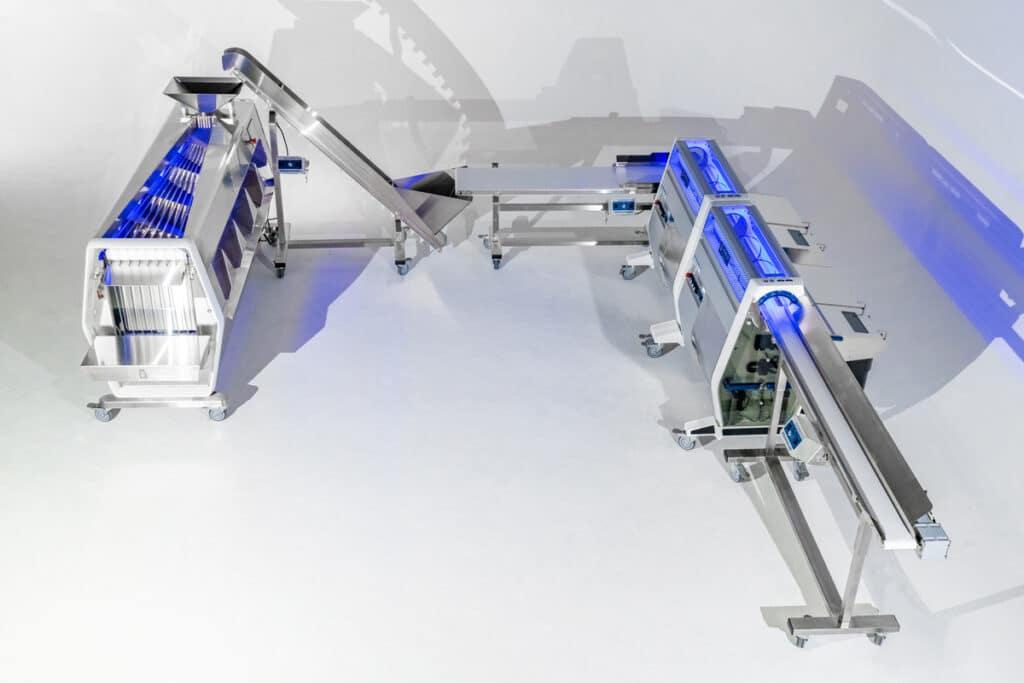

Automated cannabis processing using equipment like the Mobius end-to-end Automation Suite is the answer to these demands. Not only does machine processing reduce operating costs, but it also produces a better end product that gets to market faster.

When you purchase an Automation Suite, The Mobius team provides comprehensive design consultation services and expert analysis to ensure your facility is set up for success. We also provide on-site support after purchase to help implement our equipment and get your team onboarded. If you’d like to learn about how Mobius can help transform your cannabis processing facility, contact us today.